OEM Capital’s best practice insights in M&A

OEM Capital is a specialist in merger and acquisition advisory and investment banking services for hardware and software companies in the electronics, communications, computer, and photonics industries. We provide merger and acquisition advisory and investment banking services to companies throughout North America. Since 1985, we have initiated and completed transactions for NYSE, LSE, AMEX, NASDAQ, and OTC listed and US privately held companies. Typically, the companies we serve in a sell-side advisory role have annual revenues between US$10 – 100 million. In the instances of our involvement in the sale of a division, subsidiary, or product line, our clients have had annual revenues of up to US$2 billion. In a buy-side advisory role, we have worked with US public companies, and the US subsidiaries of foreign public companies, with market capitalizations as large as US$8 billion.

Based on our experience, we would like to share our most important insights:

1) The most important financial metric that can maximize the value of your business is not EBITDA . . . it is the Internal Rate of Return (IRR) a potential investor can expect from the investment.

it is the Internal Rate of Return (IRR) a potential investor can expect from the investment. The IRR is the most important metric used to estimate the profitability of every potential investment. The discount rate makes the Net Present Value (NPV) of all cash flows equal to zero. The higher the IRR, the more attractive the potential investment. Sophisticated private company investors aim for an IRR of 20% or higher, but in the current market environment, they often reach down for investments in the 15% range. This is the metric their investors judge them on. The IRR is primarily driven by three factors: Purchase price, projected cash flows, and an estimate of the investment’s Terminal Value at the end of the projection period. The projected cash flow is the key assumption an investor makes when determining the purchase price they will be willing to pay. It reflects market growth and share of market expectations. Capital expenditure, working capital, and people requirements are important factors in this evaluation as well. Everything that can be done do to reduce the uncertainty of projected EBITDA works in your favor – e.g., lengthy design cycle, long-term contracts. An investor will begin by analyzing the EBITDA/Revenue margin and comparing your business to similar companies. This margin indicates the added value your customers are willing to pay for your products and services, as well as your company’s competitive advantage in the market. A higher EBITDA indicates how strong and sustainable these advantages may be, and the history and consistency of growth adds confidence. Finally, a sophisticated investor will determine a level of prudent debt for his new investment. Debt reduces the amount of cash required at the time of purchase and leverages the investment to generate a higher IRR.

2) The best way to maximize the value of your business when selling all or a portion of it . . . is to reach the largest buyer pool of both Strategic and Wannabe investors

Financial investors focus exclusively on maximizing the IRR of their investment and will offer you the lowest premium because they are comparing the IRRs to lots of investment options, and they put little value on the attributes of a business that do not affect the financial return. Strategic investors will pay a premium over purely financial investors if the investment has synergies with their existing business model, expands their existing market reach, affords an opportunity for cost savings, or gives them a leg-up on their competition. Wannabe investors are not in your industry yet but are eager to get their foot in the door and are willing to pay a premium for the opportunity. Wannabe investors are fewer and harder to find, but they pay the highest premium. They are seen regularly in the technology industry to help reduce implementation risk and accelerate shorter time-to-market economic benefits. And, there are three basic ways to find the best investor

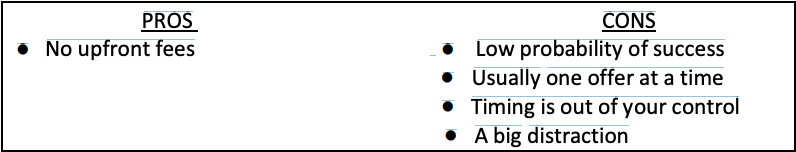

1) The “Sleeping Beauty”: Wait for Prince Charming to come calling and listen to all the benefits of selling to them versus someone else. Financial investors are fond of using this approach

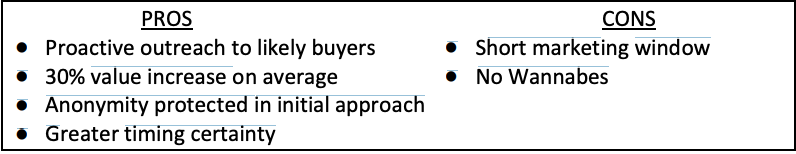

2) The “Process”: Retain an investment banking firm and run a formal sale or financing process to select the most attractive investor.

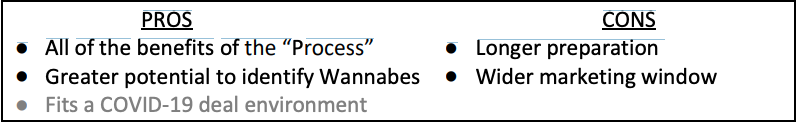

3) The “Ultimate Process”: Retain an investment banking firm specializing in your industry with international contacts and first engage in a preparatory stage before a formal sale or financing process.

Our market niche is the technology-based businesses which, because of their smaller size, are not able to command the attention of senior professionals at major investment banking firms; And, because of their technology orientation, are not easily understood by financial advisors who do not have a technical background, or remain alert to trends and current events in the industry. OEM Capital® helps major corporations, independent companies, and individuals secure premium prices from the sale or divestiture of businesses. OEM Capital® helps independent companies and shareholders develop liquidity when the sale of a business may not be appropriate. OEM Capital® advises public companies on ways to enhance shareholder value. This often includes a proactive campaign to develop acquisition or merger candidates. Our clients receive the benefit of senior executives actively managing and executing all aspects of the engagement. Our regular exposure to industry decision-makers, and merger and acquisition activity, keeps us informed of changing market conditions. Because our senior executives have a combination of investment banking and electronics industry operating expertise, we have been usually successful in securing exceptional results for our clients. Our past performance illustrates that, whether a business is healthy or impaired, maximum shareholder value can be realized by investment banking professionals who are knowledgeable about the electronics industry and the state of the financial markets. Even if you don’t expect to need Investment Banking services for 2-3 years, we can work with you in an advisory role to “extend the runway” as you prepare to make the best impression on a potential investor when the need arises. We have a flexible fee structure that allows us to work with clients to tailor fees in a way that works for both parties.

OEM Capital® is a founding member of the Alliance of International Corporate Advisors (AICA), an international organization with all the advantages of a full-service M&A firm on a global scale. AICA member firms in the United States and abroad form a select network of dedicated M&A professionals, giving OEM Capital representation in major technology centers of the world.

< Blog