The case for emerging markets: It’s about time

Productivity gains and the demographic dividend

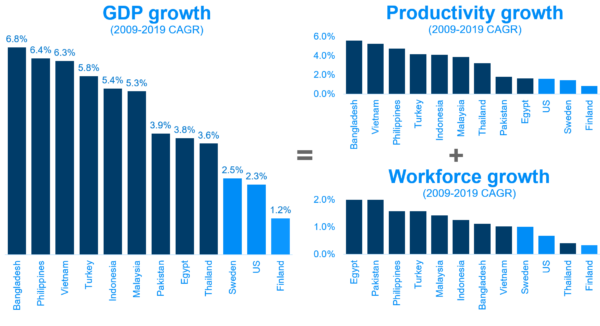

The long-term EM story is familiar to most investors: these markets grow much faster than developed economies. This is a function of more impressive productivity gains as there is greater room for improvement, and higher workforce growth as the working-age population is expanding in most emerging markets while it is shrinking in the developed world. Investors in emerging markets can capture this extra growth through the expanding corporate earnings of publicly listed companies.

Source: World Bank

Source: World Bank

Long-run EM outperformance

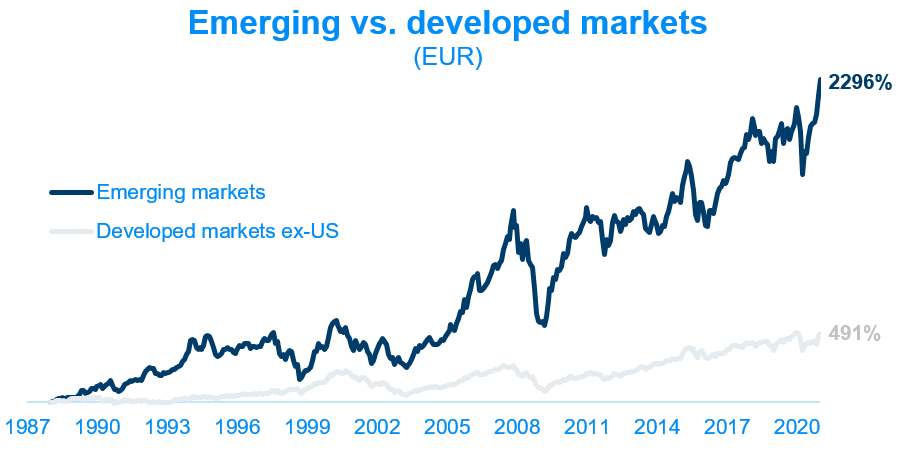

The patient investor has been rewarded for investing in emerging markets over the long run. In the last 30 years, EM has outperformed developed markets by a factor of 4x. But this is simply passive investing. An astute active investor should get rewarded with even higher returns given that emerging markets are less efficient than developed markets and thus provide compelling opportunities to find undiscovered companies as well as to unlock shareholder value through friendly activist engagement.

Source: Bloomberg.

Source: Bloomberg.

Note: Indexes used are MSCI Emerging Markets and MSCI World ex-US. Returns prior to 1999 are in USD.

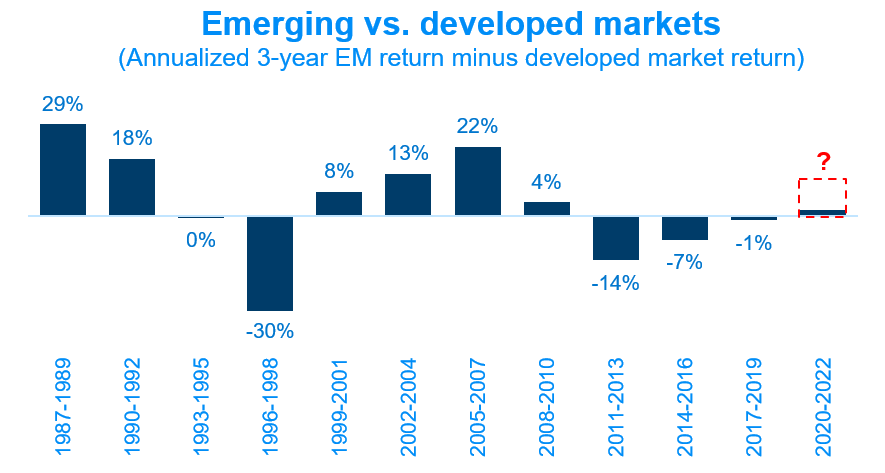

Cyclicality of EM/DM performance

Long-term performance of EM equities relative to that of developed markets equities seems to work in cycles. The past decade favoured developed markets. Might we be coming out of a long cycle of EM underperformance and entering a long cycle of EM outperformance?

Source: Bloomberg.

Source: Bloomberg.

Note: Indexes used are MSCI Emerging Markets and MSCI World.

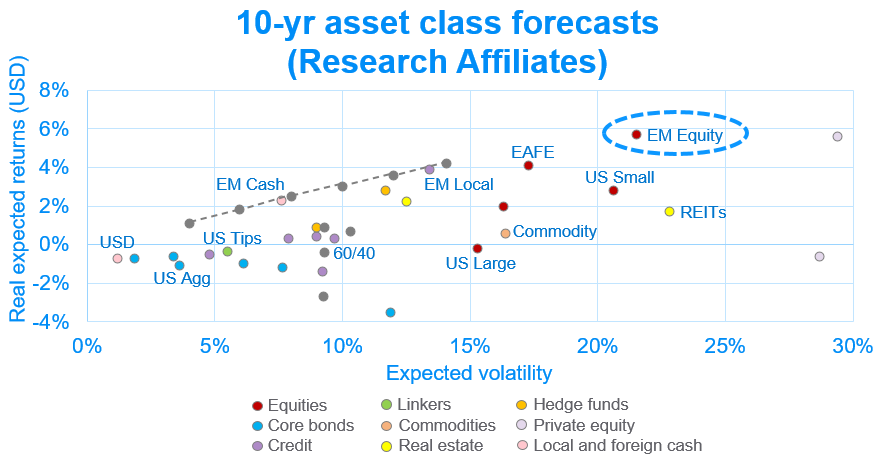

Long-term asset class forecast

Two global asset allocators with a history of making successful predictions of long-term future asset class performance, GMO and Research Affiliates, both forecast emerging markets equities to outperform all other asset classes in the next 7 and 10 years respectively. Given our focus on value, of particular excitement to our investors should be GMO’s prognosis that EM value equities will outperform the rest of EM.

Source: Research Affiliates.

Source: Research Affiliates.

Drivers of outperformance

We believe there are four main drivers behind the forecasted emerging markets outperformance: 1) recovery of the commodities supercycle, 2) a weakening US dollar, 3) attractive valuations, and 4) EM inflows due to increased allocation by institutional investors.

Conclusion

The relatively faster gains in productivity and favorable demographic backdrop are the long-term drivers for EM. However, macro cycles make EM particularly more attractive at certain times, and we are convinced now is one of those times. This conviction is supported by where we are in the commodities cycle, the low yields in developed economies and a spike in US dollar liquidity leading to a weakening dollar, cheap valuations in EM relative to developed markets, and institutional investors’ ability to push massive flows into emerging markets.

It’s time for EM to take the reins.

< Blog